Elevate your financial management skills with comprehensive SAP FICO training.

SAP FICO Training in Chennai

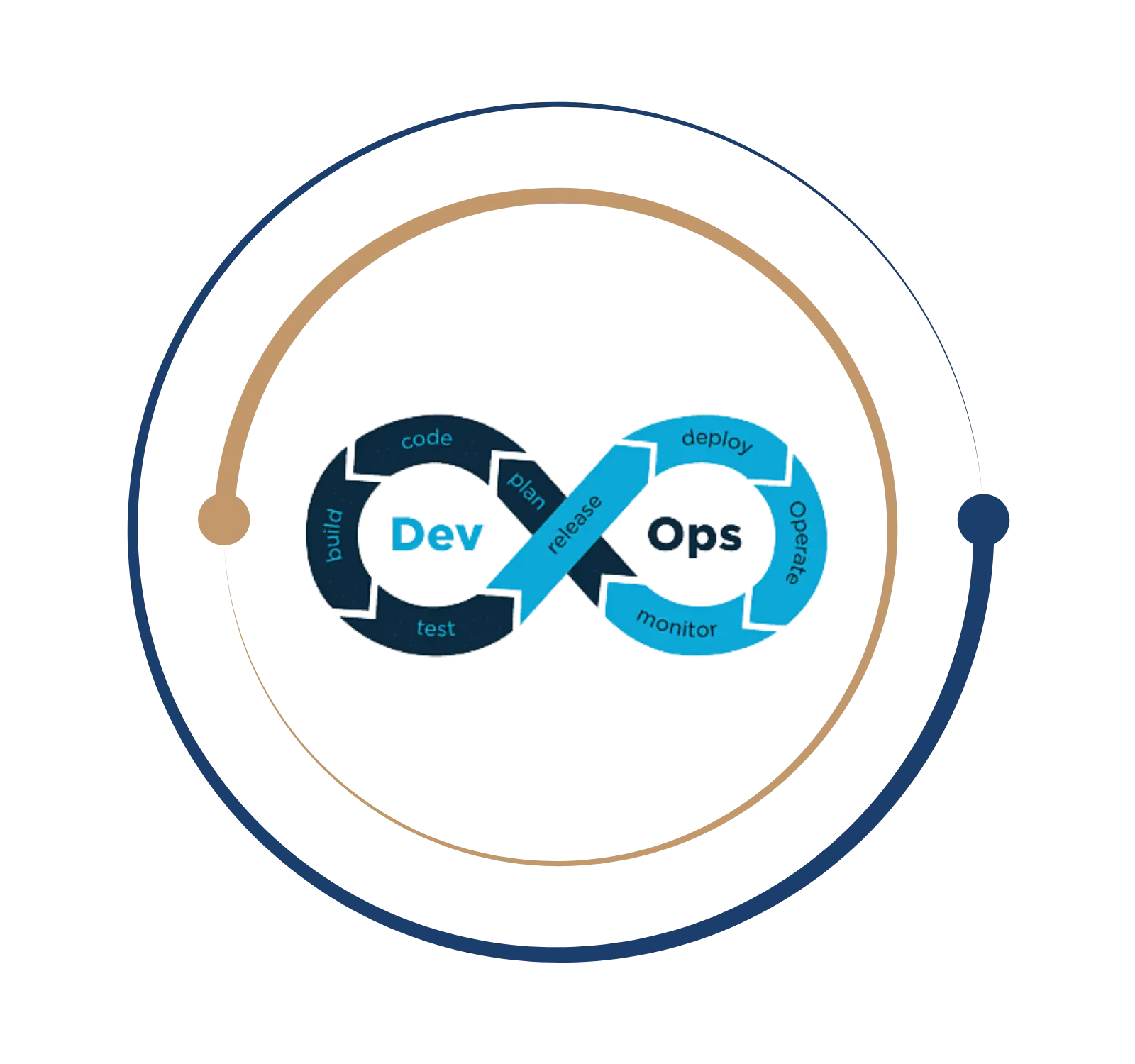

Are you looking for professional SAP FICO training? BITA Academy offers the Best SAP FICO Training in Chennai that will help you to learn Financial Accounting (FI) and Controlling (CO) modules. You will learn how to create an ERP solution that meets business needs, collaborate closely with the client finance team, and support businesses in making effective business plans.

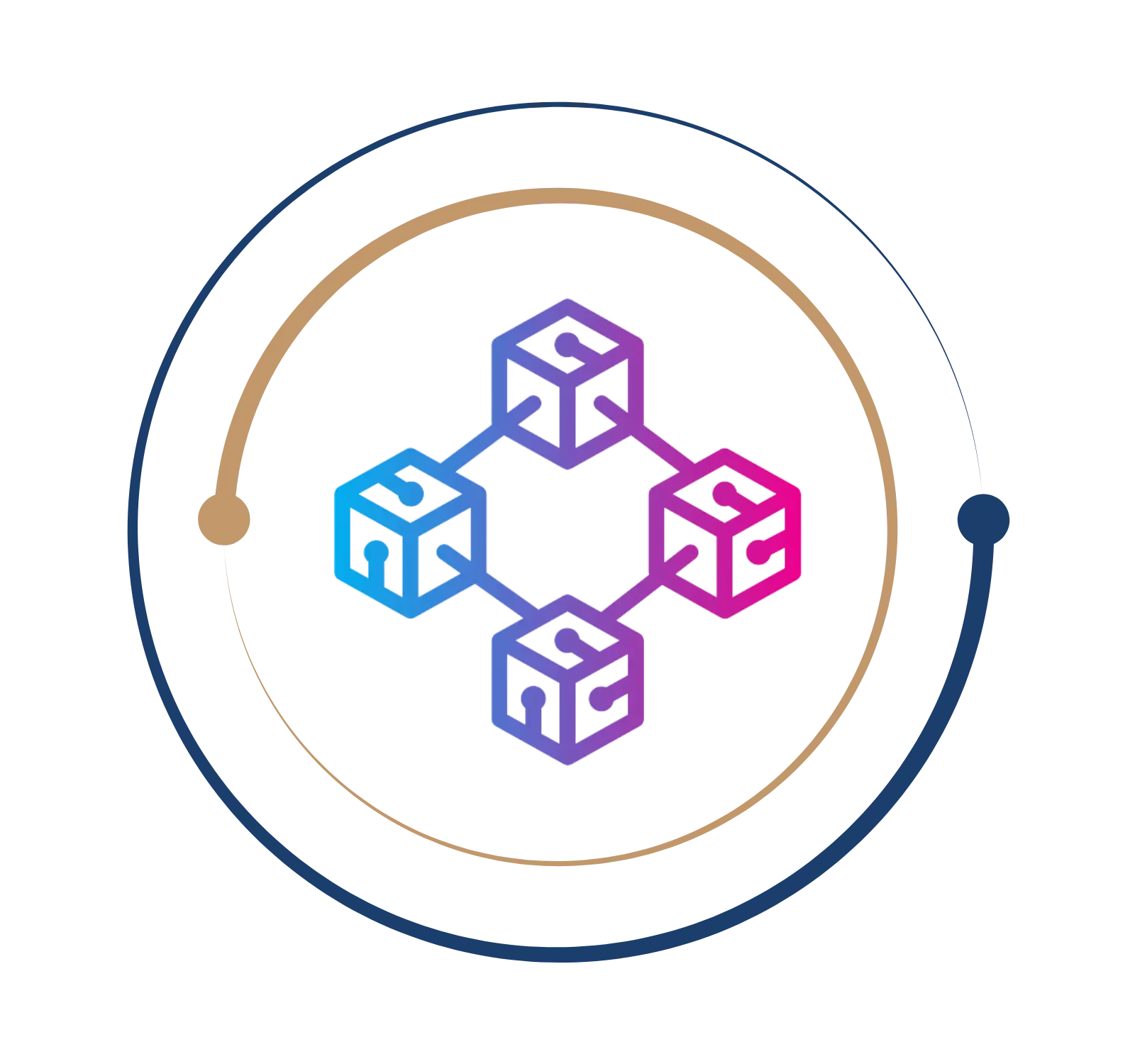

The SAP module, Finance and Controlling (FICO) is one of the most popular. The acronym SAP FICO stands for the SAP modules FI and CO. In SAP ERP Central Component, SAP FICO is a crucial core functional element that enables an organization to handle all of its financial data. A business can store a complete copy of its financial transaction data using SAP FICO.

SAP FICO Training in Chennai

Are you looking for professional SAP FICO training? BITA Academy offers the Best SAP FICO Training in Chennai that will help you to learn Financial Accounting (FI) and Controlling (CO) modules. You will learn how to create an ERP solution that meets business needs, collaborate closely with the client finance team, and support businesses in making effective business plans.

What is SAP FICO?

The SAP module, Finance and Controlling (FICO) is one of the most popular. The acronym SAP FICO stands for the SAP modules FI and CO. In SAP ERP Central Component, SAP FICO is a crucial core functional element that enables an organization to handle all of its financial data. A business can store a complete copy of its financial transaction data using SAP FICO.

Roles and Responsibility of SAP FICO Consultant

- Support the implementation and maintenance of SAP Financials.

- Identify, analyze, validate, and document client requirements while thoroughly analyzing complicated business process requirements.

- Facilitate gatherings of business requirements through seminars.

- Maps the company demands, procedures, and goals of the client; creates any necessary product alterations.

- FI/CO module design, adaptation, configuration, and testing.

- Find answers to challenges and gaps you find.

- Serve as the client’s point of contact for troubleshooting; look into, evaluate, and fix software issues.

- Record test findings, test cases, and functional designs.

- Actively identify and suggest system and business process improvements.

- Offer consultancy services for both upcoming implementations and ongoing maintenance initiatives.

The SAP module, Finance and Controlling (FICO) is one of the most popular. The acronym SAP FICO stands for the SAP modules FI and CO. In SAP ERP Central Component, SAP FICO is a crucial core functional element that enables an organization to handle all of its financial data. A business can store a complete copy of its financial transaction data using SAP FICO.

- Support the implementation and maintenance of SAP Financials.

- Identify, analyze, validate, and document client requirements while thoroughly analyzing complicated business process requirements.

- Facilitate gatherings of business requirements through seminars.

- Maps the company demands, procedures, and goals of the client; creates any necessary product alterations.

- FI/CO module design, adaptation, configuration, and testing.

- Find answers to challenges and gaps you find.

- Serve as the client’s point of contact for troubleshooting; look into, evaluate, and fix software issues.

- Record test findings, test cases, and functional designs.

- Actively identify and suggest system and business process improvements.

- Offer consultancy services for both upcoming implementations and ongoing maintenance initiatives.

Get Instant Help Here

A certification is a crucial tool for proving your skills to potential employers. Many advancements have been made to SAP applications and related certificates. The evolving market dynamics have been an ongoing challenge for these SAP certifications. To be qualified for a higher level Professional SAP certification, you must first have an Associate level SAP certification. Keep in mind that these SAP certifications highlight experts’ knowledge. Therefore, having a solid educational foundation and practical experience in your subject of interest is crucial before trying SAP certification. Many positions and responsibilities that are accepted on a worldwide basis require the qualification. The following is a list of the most common certifications for SAP consultants. Getting these credentials will enhance your resume’s worth in addition to helping your job search. After completing SAP FICO Training in Chennai with BITA, you can become certified in SAP FICO.

- SAP FICO Certification

- SAP Certified Application Professional

- SAP Certified Application Associate

- SAP Technology Consultant

It is one of the most essential and popular SAP modules. SAP FICO employment and the remuneration of an SAP FICO consultant in India are consistently in great demand. Since more and more businesses are deploying SAP, there is a massive demand for consultants, and job boards are swamped with these positions. Because SAP has been around since 1972 and is still going strong today, demand for Sap FICO jobs will always be high. People with an SAP FICO profile receive a specific career promotion and are presented with several chances. The average yearly income for an SAP Fico Consultant in India is 6.1 Lakhs, with salaries ranging from 4.0 Lakhs to 10.0 Lakhs. Signup for SAP FICO Training in Chennai.

Job you can land with SAP FICO

What you will learn?

- Deep Dive on SAP R/3 Architecture

- What do you know about ASAP method?

- Define Company

- How to Define Company Code?

- Assign Company code to company

- Define Business Area

- Define Credit control area

- Assign co code to credit control area

- Define Fiscal Year Variant

- Assign Company code to Fiscal Year Variant

- Define Posting Period Variant

- Open and Close Posting Period Variant

- Assign Company code to Posting period variant

- Define Field Status Variant

- Assign Company code to Field Status Variant

- Define Doc Number Ranges

- Define Posting Key

- How to Define Document Types?

- Define Tolerance group for Employees

- Assign Users to Tolerance group

- Maintain Global Parameters

- Define Chart of Account

- Assign Company code to Chart of Account

- Define Account Group

- Define Retained Earnings Account

- Create General Ledger Account

- Define Vendor Account Group

- Create Number Ranges for Vendor Accounts

- Assign Number Ranges to Vendor Account Groups

- Create Sundry Creditors G/L Account

- Maintain terms of payment

- Define Tolerance group for Vendors

- Create Vendor Master Data

- Automatic Payment Program

- Create Bank Key

- Define House Bank

Accounts Receivable

- Create Customer Account Groups

- Create Number range for customer accounts

- Assign Number ranges to customer account group

- Create Sundry Debtors G/L account

- Define Tolerance group for customers

- Customer Payment Terms

- Create Customer Master Data

- Dunning Procedures for Customer Configuration

- Specify structure for Tax Jurisdiction code

- Maintain Tax code

- Assign Tax codes for Non-Taxable transactions

- Define Chart of Depreciation

- Assign Company code to Chart of Depreciation

- Specify Account Determination

- Create Screen Layout Rules

- Maintain Asset Number Range

- Create New Asset Classes

- Maintain Depreciation Key

- Determine Depreciation Area in the Asset Class

- Assign General Ledger Account

- Define Screen Layout for Asset Master Data

- Define Screen Layout for Asset Depreciation Areas

- Create Asset Master Data

- Define Overhead keys

- Maintain overhead cost elements

- Define Calculation Basis

- How to Activate reconciliation ledger?

- How to deactivate reconciliation ledger?

- Create profit Center

- Create Profit Center Group

- Maintain plan versions

- Maintain Operating Concern

- Create Controlling Area

- Assign Company Code to Controlling Area

- Maintain Number Ranges for Controlling Documents

- Create Primary Cost Element

- Create Secondary Cost Element

- How to Create Cost element group?

- Create Cost Center

- Create Cost Center Group

- Do you know to Create Cost Center hierarchy?

- Create Assessment Cost Element

- Define Cost center categories

- Maintain Settlement Profile

Weekdays

Mon-Fri

Online/Offline

1 hour

Hands-on Training

Suitable for Fresh Jobseekers

/ Non IT to IT transition

Weekends

Sat – Sun

Online/Offline

1.30 – 2 hours

Hands-on Training

Suitable for IT Professionals

Batch details

Week days

Mon-Fri

Online/Offline

1 hour

Hands-on Training

/ Non IT to IT transition

Sat – Sun

Online/Offline

1:30 – 2 hours

Hands-on Training

Why should you select us?

Why should you select Us?